Key Challenges of Modern Mortgage Firms: How Outsourcing Solutions Drive Effective Growth

Robert Cohan

7 minutes read

General

•

1 year ago

Imagine your mortgage firm tangled up in complicated regulatory compliance. Regulations keep changing, and your team has to keep up. You process loan approvals slower than ever before and frustrated clients start to look elsewhere for faster service.

You might think, "We'll give performance-based bonuses to ramp up the speed.” But here’s the catch: potential clients are quick to sense band-aid solutions and are likely to reach out to more agile competitors. With a better compliance system, your competitors, except you, are the ones capitalizing on these opportunities.

Seeing this, you decided to update your systems. However, adapting to it isn't as easy as you hoped. Miss a step in compliance or due diligence, and you risk serious financial loss. Worst, your client's sensitive information could be just one mistake away from a major data breach. Now, you have a bad reputation that you can’t just rebuild overnight.

Then there's the technology shift. You bring in new systems to cut through the complexity, but the learning curve is steeper than expected. Your team should be speeding up, but instead, they're struggling to catch up. Your team is frustrated, with even lower morale and dipping productivity.

Alternatively, you consider hiring experts already up to speed with the latest tech and compliance rules. Sounds good, until the costs of hiring and training add up fast. And what if these new hires don't gel with your culture? You could end up back at square one: bogged down and outpaced by competitors.

Here’s what you realized: your best people are tied up. They're not working on what they do best—closing loans and helping clients. With time consumed on low-impact tasks, you’ve diluted your strengths.

Now you’re losing opportunities, stunting your growth and allowing competitors to outpace you.

You plunged yourself into the lows and you can’t get back up.

(This isn’t a good thing…) but, you are not alone.

Mortgage lenders are overwhelmed by the intricate array of federal and state regulations. The Dodd-Frank Wall Street Reform and Consumer Protection Act, for example, has significantly increased regulatory oversight. Compliance has become a major undertaking – study showed that 85% of firms say they are unsure whether they are in compliance last 2023. Among the 85%, 24% say that filing compliance requirements are the biggest concern. Keeping up is relentlessly demanding.

Operationally, the situation is dire. Mortgage processes are hindered by outdated manual tasks and inefficient technology. Loan officers are often submerged in paperwork, which prolongs loan processing times (average 30-40 days) and increases the likelihood of errors.

Resource management is equally challenging. Balancing staff levels to match fluctuating loan demand is difficult, often leading to either excess costs during slow periods or insufficient staffing during peak times. Mass layoffs due to rising interest rates has caused some mortgage lenders to be understaffed, as originations are expected to increase this spring.

Scaling operations in response to market or regulatory changes is also urgent and costly. Rapid adaptation requires significant investments in new technology and training to maintain operational efficiency and service quality under increased demands.

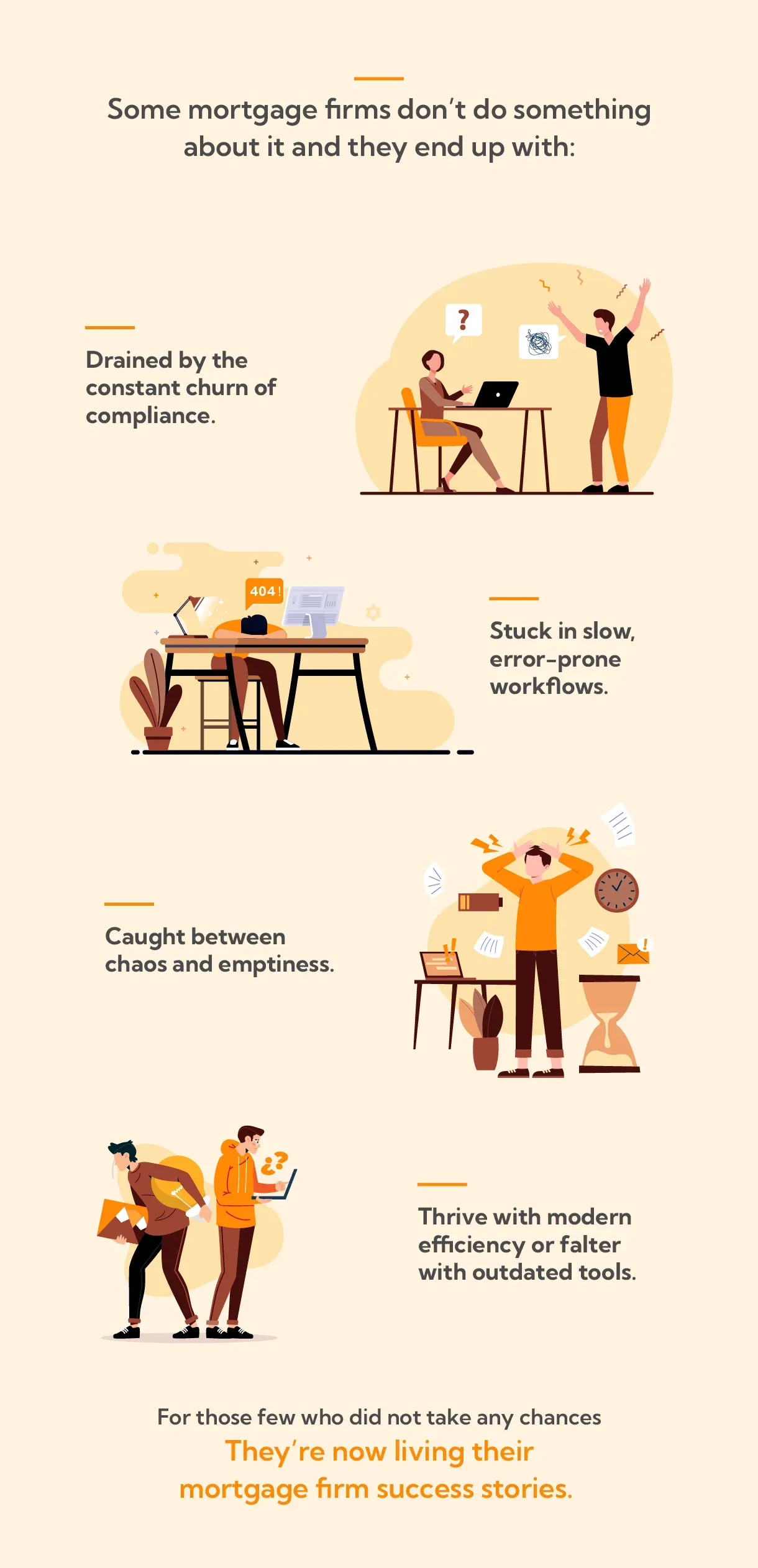

Some mortgage firms don’t do something about it and they end up with:

- Drained by the constant churn of compliance.

- Stuck in slow, error-prone workflows.

- Caught between chaos and emptiness.

- Thrive with modern efficiency or falter with outdated tools.

Want the same win?

Here's how we help you get there, too:

1. Your Problem: Complex Regulatory Compliance

Our Corebridge Solution: We will implement a compliance management system tailored to the mortgage industry. This system uses AI to monitor and adapt to changes in federal and state regulations, ensuring you stay ahead of compliance issues without the constant drain on resources. We'll handle the initial setup and provide ongoing support to manage updates and training.

2. Your Problem: Operational Inefficiencies

Our Corebridge Solution: We introduce process automation to streamline your mortgage processing workflow. By implementing digital tools that integrate seamlessly with your existing systems, we reduce the reliance on paper-based processes and manual data entry, significantly cutting down processing times and minimizing errors.

3. Your Problem: Resource Allocation Issues

Our Corebridge Solution: Our dynamic staffing solutions include predictive analytics to better forecast loan demand. This allows you to optimally adjust staffing levels and manage resources efficiently, ensuring you're well-equipped during peak times without overspending during slower periods.

4. Your Problem: Scalability Challenges

Our Corebridge Solution: We provide scalable technology infrastructure that grows with your business. Our solution includes modular tech upgrades and scalable cloud services, allowing you to handle increased loan volumes effortlessly and maintain service quality and compliance under any market conditions.

5. Your Problem: High Cost of Training and Integration

Our Corebridge Solution: We design a custom training program to smoothly transition your team to new technologies. Starting with foundational training, we gradually introduce in-depth workshops tailored to different roles within your organization, ensuring everyone is proficient and confident with the new systems.

6. Your Problem: Inconsistent Data Security

Our Corebridge Solution: Our network security experts will conduct a comprehensive risk assessment of your data handling and storage practices. We'll then enhance your data security protocols and infrastructure, training your team on best practices and monitoring systems to prevent breaches.

Experiencing similar bottlenecks and need help? Tell us more about it.

Tags

General

•

1 year ago

Related Stories